We understand that most of our players are familiar with online payments through debit and credit card but are at times skeptical about the security and confidentiality of the system. Therefore we take this opportunity to explain to our players on how Visa and MasterCard ensure security for online casino payments.

How card payments work:

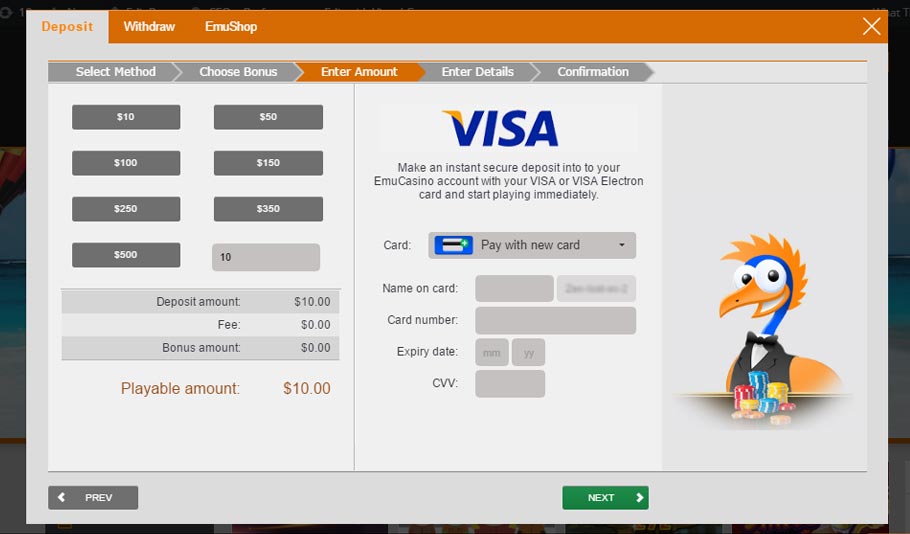

- Firstly, after you enter your details, EmuCasino verifies the legitimacy of the debit or credit card.

- Then the card payment system checks if the transaction is authorized via 3D secure

- Once the 3D security process is authorized, we will fund your account with your deposited amount.

- Then your card issuing bank transfers money to our bank through settlement.

- The system of settlement generally takes within every 24 hours when the banks connect through banking payment network.

What is 3D secure?

3D secure is a security scheming that ensures the safety and authenticity of online payment transactions through credit or debit cards. 3D secure is a strong method for online merchants as well as the buyers to tackle fraud and ensure security for both the merchants and the buyers. These are controlled by ‘Verified by Visa’ for a VISA card payment and by MasterCard SecureCode for a MasterCard payment.

So how does 3D secure make payments secure?

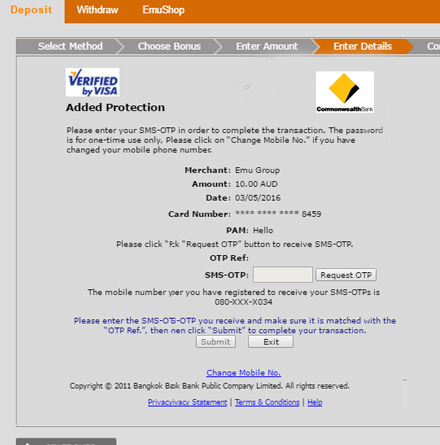

- Once the player submits their payment after entering all details, ‘Verified by Visa’ or ‘MasterCard SecureCode’ will open the website of the card issuer within the window.

- Here, cardholders are required to enter a password to authenticate and authorize the payment

- Generally, this is a One Time Password, also known as OTP. In some cases, players need to ‘Request an OTP’ by clicking a button.

- This OTP is generally sent to your mobile number that is associated with your debit or credit card.

- Once you enter and submit the OTP, the issuing bank will verify the OTP and approve your payment.

So why is 3D secure important in card payments?

- Only fraud prevention scheme that allows security to both players and the merchant

- Detects unauthorized card usage

- Merchants are protected from fraud, therefore are able to provide the service immediately.

- Banks can authenticate both the purchase and sell of the service

- Concerned authorities can track the transaction upon disputes

Please note that the above image is only an illustration for reference, your banking page may look different.